Return on investment leverage formula

Annualized Rate of Return 990 600 990 1 10 1 Annualized Rate of Return 485 Therefore the investor earned an annualized rate of return of 485 from the bond investment over the 10-year holding period. The net debt to earnings before interest depreciation and amortization EBITDA ratio is a measurement of leverage calculated as a companys interest-bearing.

Leverage Ratio Formula And Calculator Excel Template

We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

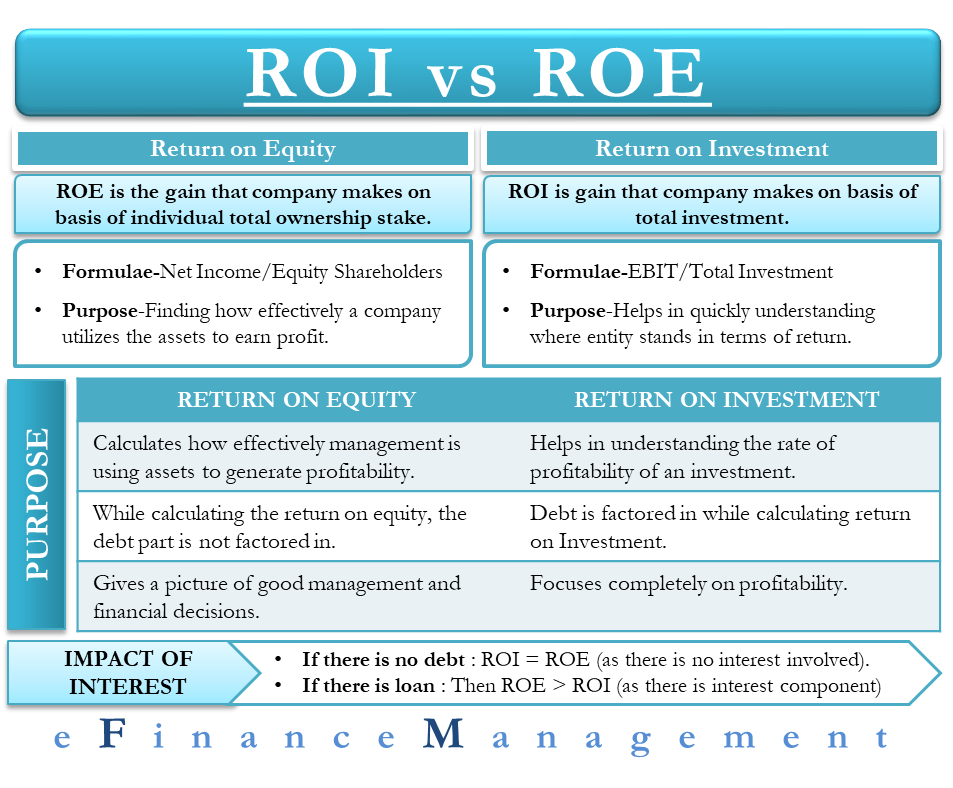

. The name comes from the DuPont company that began using this formula in the 1920s. No ROI is not the same as ROE. Calculate the holding period return of the investment for Stefan based on the given information.

It distinguishes the financial and investment income from the operating income. And methods of figuring leveragethe. If the required rate of return from the project is sat 10 and the average rate of return is coming out to be 15 that project will look worth investing.

Return on investment ROI is a metric used to understand the profitability of an investment. A return on investment ROI for real estate can vary greatly depending on how the property is financed the rental income and the costs involved. Weve developed a suite of premium Outlook features for people with advanced email and calendar needs.

DuPont analysis also known as the DuPont identity DuPont equation DuPont framework DuPont model or the DuPont method is an expression which breaks ROE return on equity into three parts. The return on investment ROI formula remains the same whether youre evaluating the performance of a single stock or considering the potential profit of a real estate investment. It included the transactional costs of investment legal management auditor fees and many other miscellaneous operational expenses determining the final.

Let us see an example to understand it. An investor purchase 100 shares at a price of 15 per share and he received a dividend of 2 per share every year and after 5. The internal rate of return allows investments to be analyzed for profitability by calculating the expected growth rate of an investments returns and is expressed as a percentage.

The RNOA figure provides useful insights into a companys ability to generate profits from equity resources. In order to satisfy investors a company should be able to generate a higher ROE than the return available from a lower risk investment. DuPont explosives salesman Donaldson Brown invented the formula in an internal efficiency.

ROI compares how much you paid for an investment to how much you earned to evaluate its efficiency. Age of a company Age Of A Company Financial Leverage Ratio measures the impact of debt on the Companys overall profitability. ROI is return on investment.

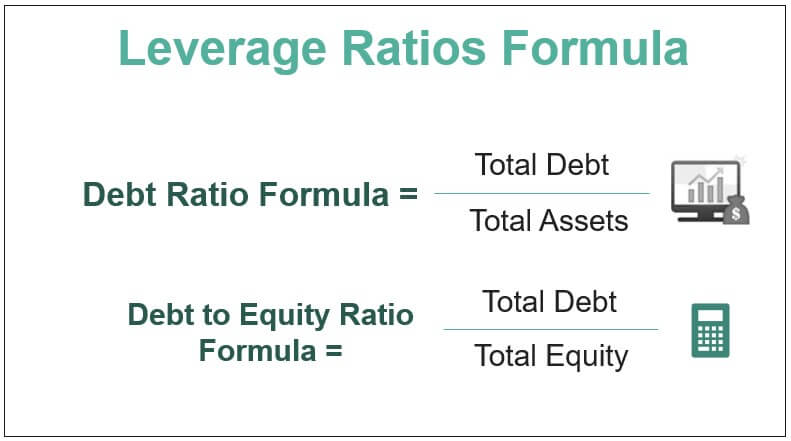

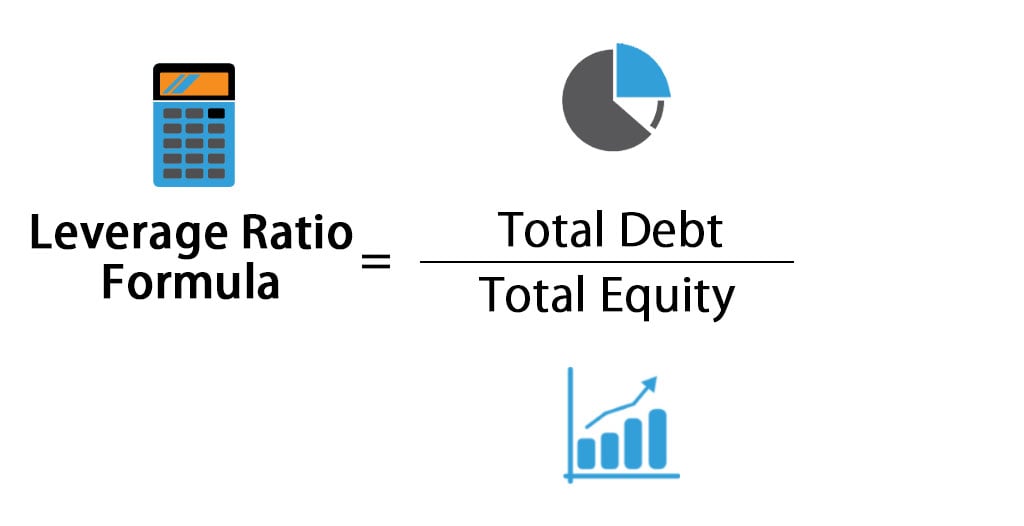

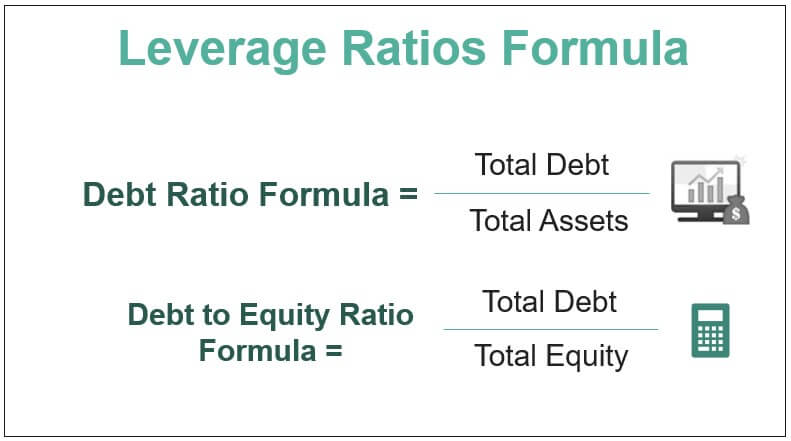

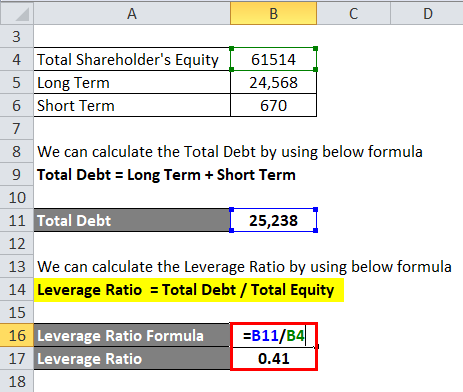

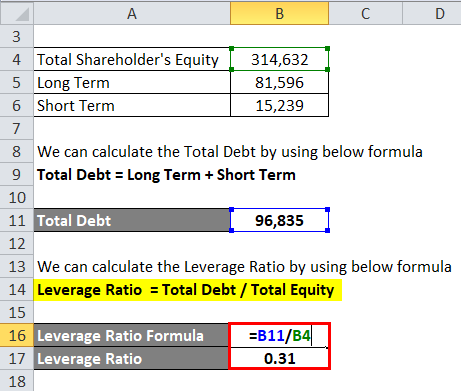

In Year 1 300 in Year 2 and 400 in Year 3. The formula for its calculation is the ratio of Total Debt to Shareholders Equity. Moreover high low ratio implies high low fixed business investment cost respectively.

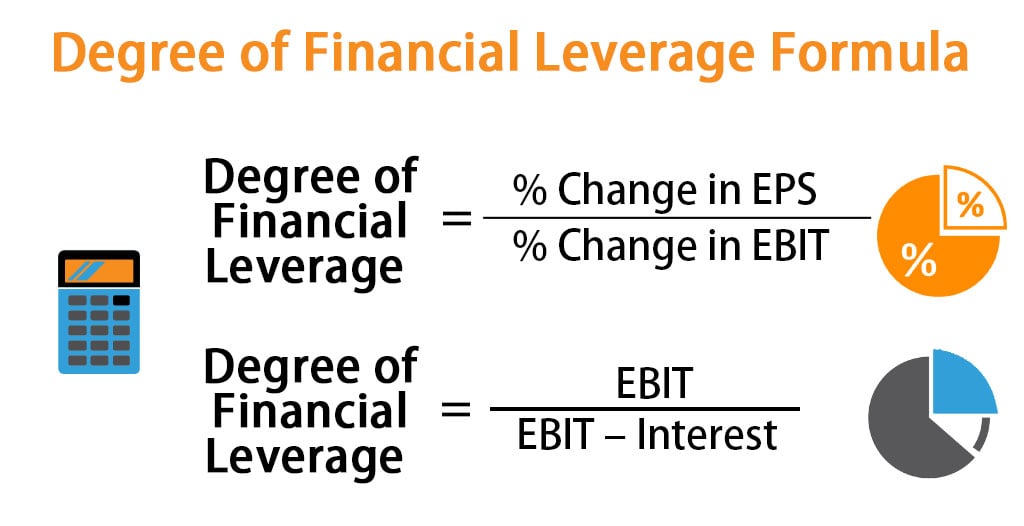

Now compute the percentage change in EBIT initially by deducting the EBIT of the previous year from that of the current year and then dividing the result by the EBIT of the previous year as shown below. Holding Period Return Formula. It was triggered by a large decline in US home prices after the collapse of a housing bubble leading to mortgage delinquencies foreclosures and the devaluation of housing-related securities.

Ln50 004 17329 years to retire at 50 savings rate ln80 004 55786 years to retire at 80 savings rate. The main reason is leverage the unsung hero of real estate investing. The formula can be derived by using the following three steps.

Lastly if the firms financial leverage increases the firm can deploy the debt capital to magnify returns. If you plug in 4 youll get numbers close to what you have in the table above. In this formula any gain made is included in formula.

Total Annualized Return Cash Flow Principal Pay Down Appreciation. I think by interest rate on savings he means any investment return not necessarily the interest rate on a savings account in a bank. Fund performance and the potential to give a high rate of return on investments Rate Of Return On Investments Rate of Return on Investment is the rate at which a company generates a return on investment during a period when compared to the cost of the investment made by the.

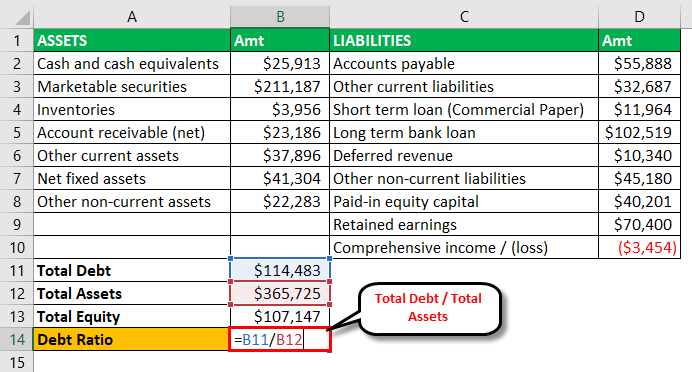

Financial Leverage Formula Total Debt Shareholders Equity. Typically expressed in percentage form the ROE metric can be a very useful tool to gauge a management teams capital allocation decisions and ability to drive shareholder value creation. In an efficient market higher levels of credit risk will be associated with higher borrowing costs.

The United States subprime mortgage crisis was a multinational financial crisis that occurred between 2007 and 2010 that contributed to the 20072008 global financial crisis. So to restate the formula. Net Debt To EBITDA Ratio.

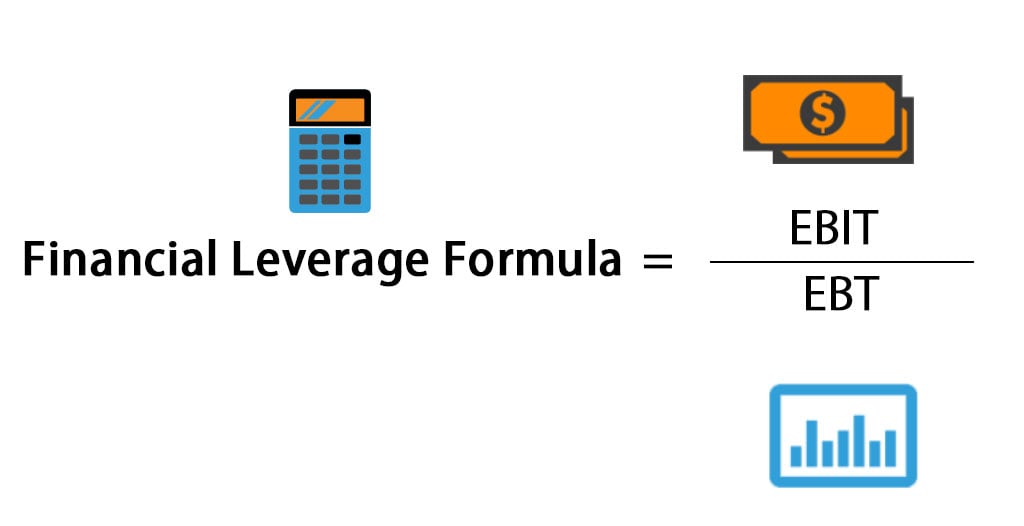

When we first bought our property we put 25 down giving a leverage ratio of 41. Firstly determine the operating income vs. Formula of Financial Leverage Formula Of Financial Leverage Financial Leverage is defined as a Companys degree of dependency on debt financing to enhance its Return-On-Investment.

The following is the ROE equation. Currently the stocks are valued at 5500. That can be detrimental and can lead us to make the wrong capital investment decision.

Hence the current earnings and cash flows are a relatively small component of the total net return instead the ability to reinvest those earnings to build real value is much more important. A Microsoft 365 subscription offers an ad-free interface custom domains enhanced security options the full desktop version of Office and 1. Return on Equity Formula.

Time Value of Money Formula. A credit risk is risk of default on a debt that may arise from a borrower failing to make required payments. Get 247 customer support help when you place a homework help service order with us.

Rate of Return Formula Example 3. In the first resort the risk is that of the lender and includes lost principal and interest disruption to cash flows and increased collection costsThe loss may be complete or partial. Return on Net Operating Assets 130000 550000.

Total Expense Ratio Formula Total Expense Ratio Formula The total expense ratio is the total investment cost to the investor who invests in a mutual fund equity fund or exchange-traded fund. EBIT during the current and previous years. Generally the higher the return on invested capital ROIC the more likely the company is to achieve sustainable long-term value creation.

Hence Return on Net Operating Assets 02363 or 2363. Like we have discussed above the time value of money has been ignored in the average rate of return formula. Return on Equity ROE measures the net profits generated by a company based on each dollar of equity investment contributed by shareholders.

Leverage Ratios Formula Step By Step Calculation With Examples

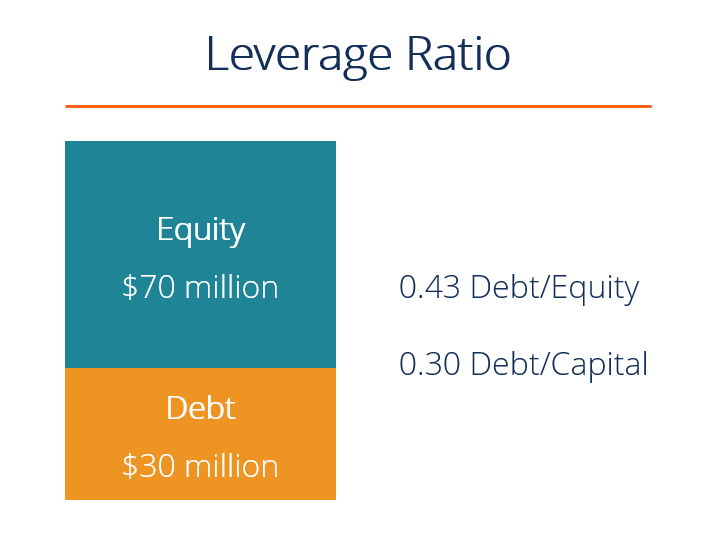

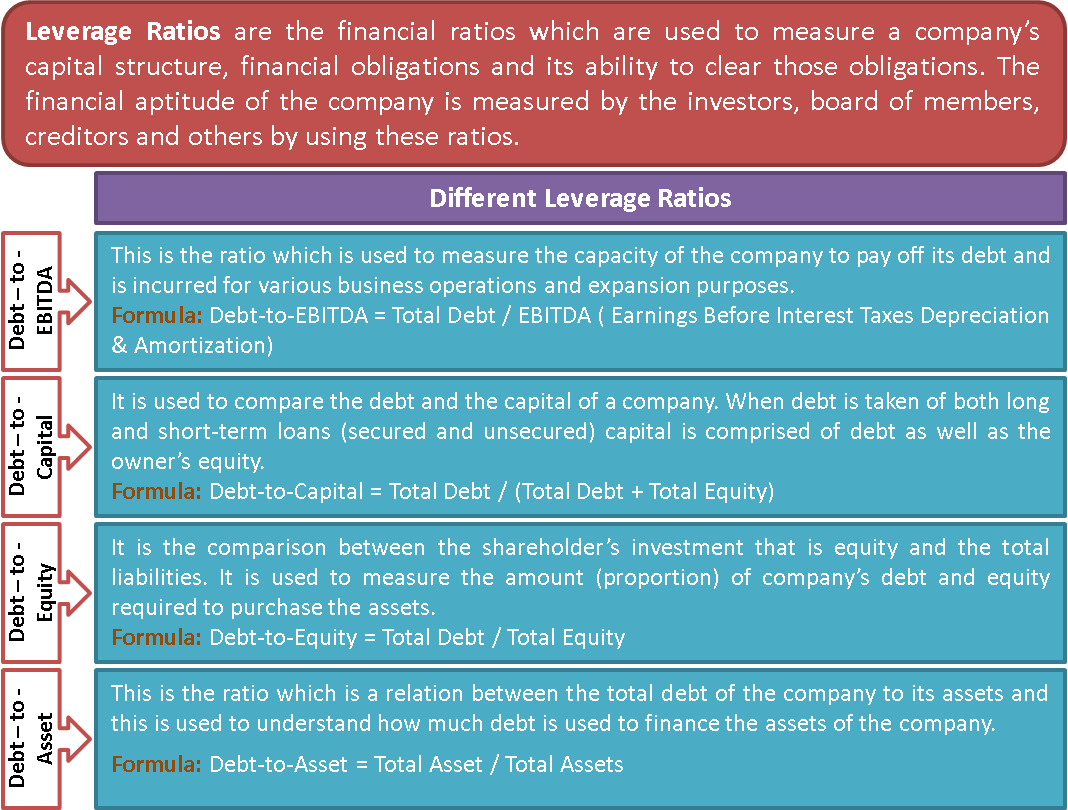

Leverage Ratios Debt Equity Debt Capital Debt Ebitda Examples

Leverage Ratio Formula Calculator Excel Template

Leverage Ratios Formula Step By Step Calculation With Examples

Degree Of Financial Leverage Formula Calculator Excel Template

Leverage Ratios Formula Step By Step Calculation With Examples

Leverage Ratios Debt Equity Debt Capital Debt Ebitda Examples

Leverage Ratio Formula Calculator Excel Template

Roi Vs Roe All You Need To Know

/What_Is_Financial_Leverage-v2-f9b17daa798a4155857c7963372e625b.png)

What Is Financial Leverage

Leverage Ratio For Banks Purpose Of Leverage Ratio For Banks

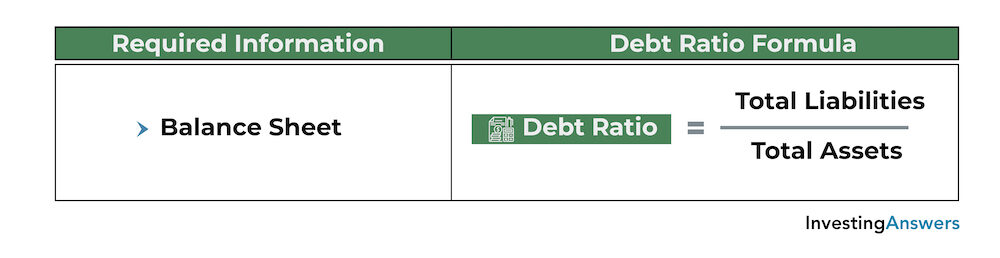

Leverage Ratio Meaning Interpretation Investinganswers

Leverage Ratio Economics Help

Leverage Ratios Calculation And Formula Uses Of Leverage Ratios

Leverage Ratio Formula Calculator Excel Template

Financial Leverage Formula Calculator Excel Template

Leveraged Yield Of Return For Your Property Investment Moats